Vietnam Continues to be The Foremost Provider of Shrimp to Japan.

In the first half of this year, the Japanese market purchased $236 million USD worth of shrimp from Vietnam, a decrease of 29% from the same period. The shrimp export to Japan from Vietnam in June 2023 decreased by 35%, the steepest decline since March of this year.

The export of Vietnamese shrimp to Japan faced difficulties earlier this year due to the sharp depreciation of the Japanese Yen. By the beginning of July 2023, the Yen had depreciated significantly, exceeding 145 yen per USD. This posed challenges for shrimp consumption in this market, as prices had to be lowered to match the decline of the Japanese yen.

Among the three main shrimp product categories exported to Japan, white-leg shrimp (vannamei) accounted for 63.5%, black tiger shrimp (monodon) accounted for 17.9%, and the remaining 18.6% was other shrimp types. Unlike other markets, the proportion of other shrimp types exported to Japan is higher than that of black tiger shrimp. The value of white-leg shrimp exports to Japan in the first half of 2023 reached $150 million USD, a decrease of 26%, while the value of black tiger shrimp exports decreased by 45% to $42 million USD. Notably, the export of other shrimp types to Japan increased to $44 million USD, a decrease of 15%.

In the first six months of 2023, the average export price of frozen white-leg shrimp from Vietnam to Japan ranged from $6.5 to $10.3 USD/kg. The average export price of frozen black tiger shrimp to Japan ranged from $14.1 to $17.7 USD/kg. The average export prices of frozen white-leg and black tiger shrimp to Japan in the second quarter of this year showed a slight decrease compared to the first quarter.

Japan has also seen increased export efforts by many businesses this year due to the perceived stability in demand and higher profitability rates in Japan, thanks to high-value-added products and improved processing. With domestic raw shrimp supply decreasing due to shrimp diseases, Vietnamese processed shrimp products maintain an advantage over other markets when exported to Japan.

Some of the largest shrimp exporting companies to Japan include Sao Ta Food JSC, Hai Viet JSC, Minh Phu Corporation, and Minh Phu Corporation Hau Giang.

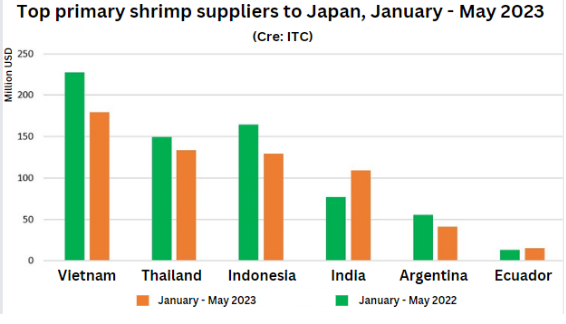

In the Japanese market, Vietnamese shrimp also competes with shrimp from India and Ecuador. According to data from the International Trade Centre (ITC), in the first five months of this year, while total shrimp imports to Japan decreased by 11%, imports from the largest source, Vietnam, also recorded a decline, but Japan's imports from India and Ecuador grew significantly, by 43% and 20% respectively. Data from the Indian Ministry of Commerce showed that in the first five months of this year, Japan saw strong growth in imports of black tiger shrimp from India.

Vietnam remains the largest shrimp supplier to Japan, holding a market share of 23.7%. Thailand ranks second with a market share of 17.7%. India ranks fourth with 14.5% and Ecuador ranks tenth with 2.1%.

Cre: vasep.com.vn

Indian shrimp pivot to the EU, increasing competitive pressure on Vietnam

Indoor shrimp farming in Europe: Investment challenges and the race to find a viable model

Shrimp production surged in the first month of the year, with exports benefiting from strong demand during the Lunar New Year holiday

Quang Ninh Accelerates Digital Transformation in Shrimp Farming, Rising to Lead Northern Vietnam

Lucky money is not just about cash — it’s Aqua Mina’s wish for a worry-free farming season for our valued customers

Việt Nam's top 10 seafood exporters command nearly one-fifth of industry revenue

Ca Mau Maintains Its Shrimp Brand in International Competition

VIETSHRIMP ASIA 2026 & AQUACULTURE VIETNAM 2026 – A TURNING POINT FOR THE MODERN SHRIMP FARMING INDUSTRY

Ecuador's shrimp industry educational program SustainED kicked off its 2026

An Giang will start raising brackish water shrimp as early as the beginning of 2026

Aqua Mina conducts the on-site installation of two aquaculture air blowers | Ceramic Ball Bearing – 15 kW – 25 kPa for a customer in Quang Ninh

Towards Building Brand Value for the Shrimp Industry

.jpg)