Will U.S. Countervailing Duties Reshape the Global Shrimp Trade?

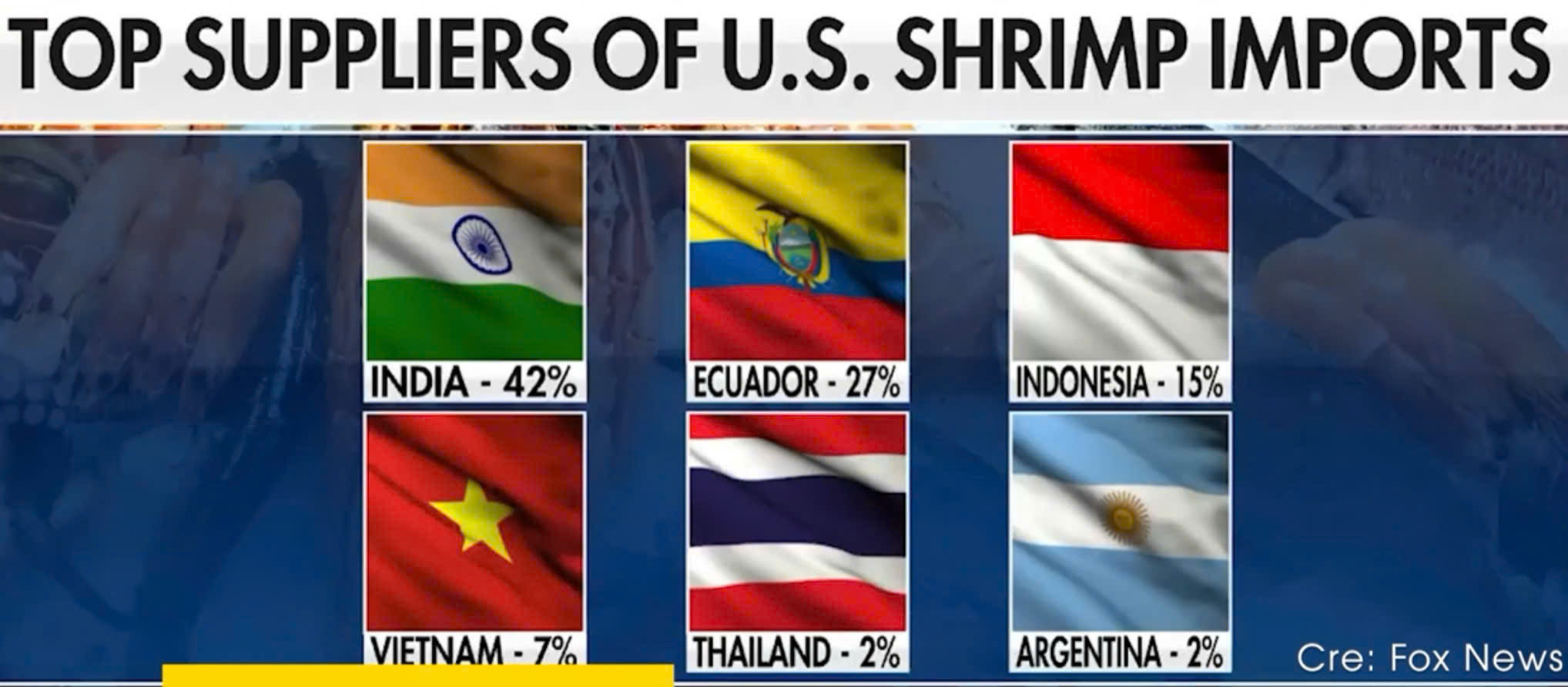

With such a large disparity, Vietnamese seafood—especially shrimp, one of the country’s top export items with billion-dollar revenue to the U.S. in 2024—can hardly remain competitive, especially when Ecuador faces only a 10% duty.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), the U.S. has consistently been Vietnam's largest and most traditional shrimp export market, accounting for around 20% of the country’s total shrimp export value.

Vietnam’s shrimp export revenue to the U.S. has ranged from USD 800 million to 1 billion annually, with a record USD 1 billion reached in 2021. Currently, about 230 Vietnamese companies are exporting shrimp to the U.S.

A 46% tariff renders Vietnamese businesses uncompetitive, and even if U.S. consumers are willing to support, the increased cost may be too burdensome.

Previously, companies estimated a possible tariff of around 10%, but the actual rate turned out to be much higher. Without intervention from the Vietnamese government or negotiations to reduce the tariff, withdrawal from the U.S. market may no longer be just a hypothetical scenario.

Another concern is whether the U.S. applies the new tax based on the date goods arrive at port instead of the shipment date. If so, shipments that departed Vietnam before April 5 but have yet to arrive in the U.S. could still face the new duty, potentially causing major losses. A shipment worth USD 5 million could lose over USD 2 million due to the 46% duty—an enormous financial burden for exporters.

In addition to the new tariff, Vietnam's shrimp exports are also under pressure from two ongoing cases: anti-dumping (AD) and countervailing duty (CVD) lawsuits in the U.S.

How Will the Global Shrimp Trade Landscape Shift?

According to Shrimp Insights, although it's too early to predict with certainty, President Trump's new trade policy will clearly have a significant short-term impact and may cause lasting changes to global shrimp trade flows in the medium and long term.

Ecuador and several smaller producers like Argentina, Honduras, Mexico, Guatemala, Peru, and Saudi Arabia will gain a strong competitive advantage over most Asian countries. They are well-positioned to expand market share.

Ecuador and other Latin American producers are expected to scale up production of peeled and value-added shrimp products—high-demand items in the U.S.—especially as Chinese demand remains unstable. Expanding in the U.S. market will also help Ecuador reduce dependency on China.

Among Asian nations, India, despite facing a 26% tariff, still retains a relative advantage compared to Indonesia (32%), Thailand (36%), and Vietnam (46%). India can target product segments that Latin American producers are not yet prepared to supply.

Although Indian shrimp stock prices plummeted overnight, the Indian shrimp industry has already proven resilient amid past disruptions. Indian exporters are likely to maintain their position in segments where Latin America falls short in meeting demand.

India is also expected to strengthen relationships with U.S. retailers while expanding exports of peeled and processed shrimp to the EU and other markets. Moreover, India could diversify into other aquatic species and further develop its shrimp farming, processing, and export value chains.

In contrast, producers in Indonesia and Vietnam are in the most difficult positions—facing high production costs, steep U.S. tariffs, and intense competition from Ecuador and India in other markets. Developing a strong domestic market will take time, and competition in alternate markets will be tough.

Smaller exporters like Bangladesh and Sri Lanka may suffer even more severe consequences and might struggle to continue exporting to the U.S.

On the U.S. side, domestic shrimp farmers and fishermen may increase production and market share due to the new competitive edge. However, they are unlikely to meet the country’s massive shrimp demand due to production constraints that go beyond just pricing.

Source: nongnghiep.vn

Aqua Mina's distributor in Japan: REX INDUSTRIES CO., LTD

- Address: 1-9-3 Hishiya-Higashi, Higashi-Osaka 578-0948 JAPAN

- Email: kimakubo@rexind.co.jp

- Phone: +81-(0)72-961-9893

- Website: http://www.rexind.co.jp/e/

WE WORK FOR YOUR SUCCESS!

Ngày đăng : 25/04/2025

1955 View

Other Articles

Indian shrimp pivot to the EU, increasing competitive pressure on Vietnam

Indoor shrimp farming in Europe: Investment challenges and the race to find a viable model

Shrimp production surged in the first month of the year, with exports benefiting from strong demand during the Lunar New Year holiday

Quang Ninh Accelerates Digital Transformation in Shrimp Farming, Rising to Lead Northern Vietnam

Lucky money is not just about cash — it’s Aqua Mina’s wish for a worry-free farming season for our valued customers

Việt Nam's top 10 seafood exporters command nearly one-fifth of industry revenue

Ca Mau Maintains Its Shrimp Brand in International Competition

VIETSHRIMP ASIA 2026 & AQUACULTURE VIETNAM 2026 – A TURNING POINT FOR THE MODERN SHRIMP FARMING INDUSTRY

Ecuador's shrimp industry educational program SustainED kicked off its 2026

An Giang will start raising brackish water shrimp as early as the beginning of 2026

Aqua Mina conducts the on-site installation of two aquaculture air blowers | Ceramic Ball Bearing – 15 kW – 25 kPa for a customer in Quang Ninh

Towards Building Brand Value for the Shrimp Industry

.jpg)