A Deep Dive into China's Shrimp Farming Industry

Whiteleg Shrimp Dominate China's Shrimp Supply

According to Dr. Luca Micciche, Technical Director at Verdesian Life Sciences, China’s total shrimp production in 2024 is expected to reach 2.5 million tons, with whiteleg shrimp (Litopenaeus vannamei) accounting for a dominant 93% of that output.

While China’s shrimp sector experienced impressive growth from 2004 to 2020 at an average of 5.2% annually, this pace has slowed significantly since 2020—dropping to just 1% per year—due to the impact of COVID-19 and global economic volatility. This abrupt shift signals a pressing need for the industry to adapt and find optimal solutions for the new market landscape.

Farming Models and Trends

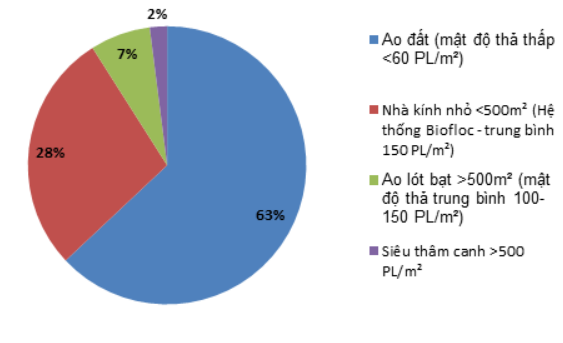

Out of China’s 7.39 million hectares of aquaculture area, shrimp farming occupies approximately 10%. An estimated 450,000 shrimp ponds are currently operational, at varying scales (source: Robins McIntosh, Charoen Pokphand Foods, Thailand).

Among farming systems, small greenhouse ponds (stocking density of 150 PL/m²) have gained significant attention, growing at 12% from 2020–2024—far outpacing the 2% growth rate of traditional earthen ponds (stocked at 60 PL/m²). Lined ponds with 100–150 PL/m² are also growing steadily at 8%.

Figure 1. The four main whiteleg shrimp farming models in China.

(Source: Dr. Luca Micciche, “Latest Developments in China’s Shrimp Farming: Challenges and Opportunities,” Global Shrimp Forum 2024)

To boost yields, many operations have turned to high-tech super-intensive systems with densities up to 1,200 PL/m². However, this model now grows at just 6%, primarily due to disease outbreaks and environmental pollution, raising concerns about long-term sustainability. The challenge lies in balancing economic efficiency with environmental protection.

Dr. Micciche assessed six farming models based on criteria such as biosecurity, profitability, scalability, and sustainability. The small greenhouse model, using biofloc systems with an average density of 125 PL/m² and occupying less than one mu (666.7 m²), emerged as the most balanced and effective. This highlights its potential for broader application in China.

Inside the Small Greenhouse Model

In Rudong, Jiangsu Province, the small greenhouse shrimp farming system has proven highly efficient. Ponds ranging from 320–360 m², stocked at 150 PL/m², and covered with plastic sheets allow tight environmental control. Minimal water exchange (5–10%) combined with EM (Effective Microorganisms) helps maintain a stable ecosystem with low disease incidence.

Each 40m x 9m pond (360 m²) can yield nearly 1 ton of shrimp after three production cycles. Deeper pond construction enhances yields by up to 50%, allows polyculture, and reduces risk.

Biosecurity is a top priority. Thanks to the closed system, water exchange is rare. The greatest infection risk comes from post-larvae (PL). Farmers are vigilant in screening for harmful bacteria such as Vibrio, while EHP (Enterocytozoon hepatopenaei) is considered the most economically damaging pathogen. Additionally, HLV (Larval Mortality Virus) poses a severe early-stage threat. To mitigate risks, growers aim to accelerate shrimp growth at minimal cost.

Although many farms use groundwater, this practice often lacks regulatory approval. Authorities now monitor wastewater and shrimp samples more strictly. Farms risk being shut down if pollution or antibiotic misuse is detected.

Production Costs and Farmgate Prices

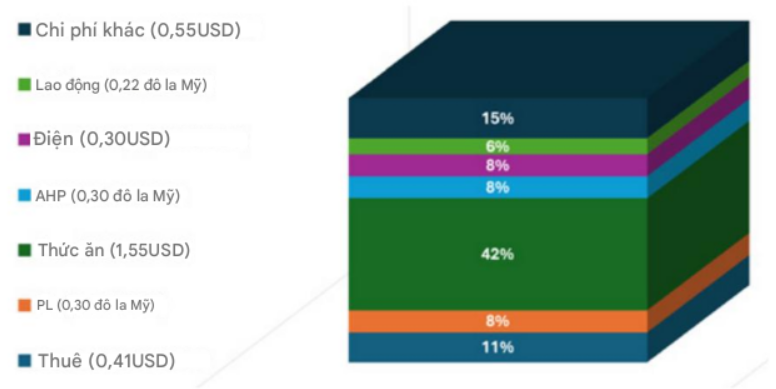

Figure 2. Estimated production cost per kg in 2024 under the small greenhouse model. Without heating: $3.65/kg; with heating: +$1.25/kg.

(Source: Dr. Luca Micciche, Global Shrimp Forum 2024)

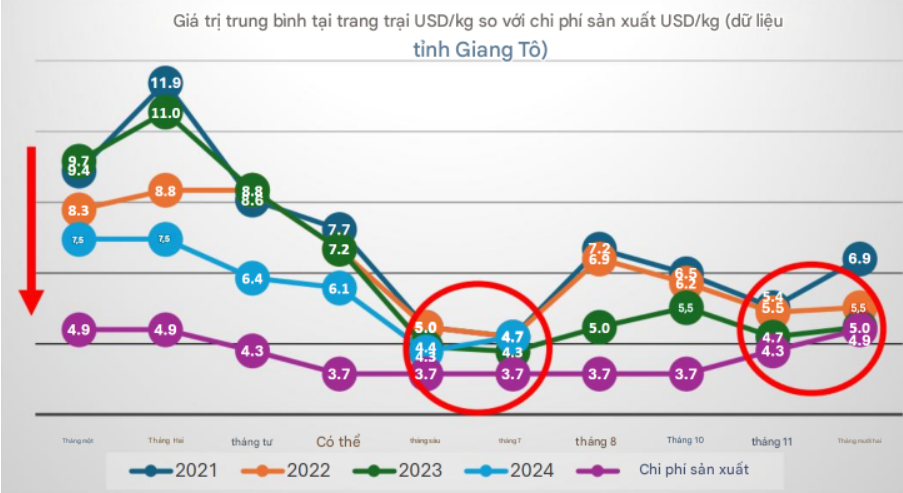

Production costs currently range from $3.00 to $3.60 per kg, but farmgate prices have been dropping for four consecutive years. By late 2024, cost and selling price could equalize, leading to potential losses for farmers.

One proposed solution: reduce feed protein content, since high-protein feed costs between $1.30–1.80/kg. Farmers require a minimum selling price of $5.00/kg to remain viable. Reformulating feed and lowering input costs is now a priority.

Figure 3. Farmgate prices (USD/kg) vs. production costs (USD/kg) in Jiangsu Province. Red circles highlight the price–cost parity forecast for mid and late 2024.

(Source: Dr. Luca Micciche, Global Shrimp Forum 2024)

Outlook for the Remainder of 2024 and Beyond

As 2024 winds down, shrimp farms in China must tackle two major challenges:

Supplying high-quality live shrimp for domestic markets.

Competing with frozen imports, particularly from Ecuador.

Success will depend on producing resilient, fast-growing shrimp that can endure long-distance transportation. A strong supply of disease-free broodstock is also essential.

Experts believe China’s market still has room for both domestic and imported shrimp, with rising demand projected for 2025, likely improving prices and restoring farmer confidence.

Source: aquaculture.vn

Aqua Mina's distributor in Japan: REX INDUSTRIES CO., LTD

- Address: 1-9-3 Hishiya-Higashi, Higashi-Osaka 578-0948 JAPAN

- Email: kimakubo@rexind.co.jp

- Phone: +81-(0)72-961-9893

- Website: http://www.rexind.co.jp/e/

WE WORK FOR YOUR SUCCESS!

Ngày đăng : 17/06/2025

1944 View

Other Articles

Indian shrimp pivot to the EU, increasing competitive pressure on Vietnam

Indoor shrimp farming in Europe: Investment challenges and the race to find a viable model

Shrimp production surged in the first month of the year, with exports benefiting from strong demand during the Lunar New Year holiday

Quang Ninh Accelerates Digital Transformation in Shrimp Farming, Rising to Lead Northern Vietnam

Lucky money is not just about cash — it’s Aqua Mina’s wish for a worry-free farming season for our valued customers

Việt Nam's top 10 seafood exporters command nearly one-fifth of industry revenue

Ca Mau Maintains Its Shrimp Brand in International Competition

VIETSHRIMP ASIA 2026 & AQUACULTURE VIETNAM 2026 – A TURNING POINT FOR THE MODERN SHRIMP FARMING INDUSTRY

Ecuador's shrimp industry educational program SustainED kicked off its 2026

An Giang will start raising brackish water shrimp as early as the beginning of 2026

Aqua Mina conducts the on-site installation of two aquaculture air blowers | Ceramic Ball Bearing – 15 kW – 25 kPa for a customer in Quang Ninh

Towards Building Brand Value for the Shrimp Industry

.jpg)