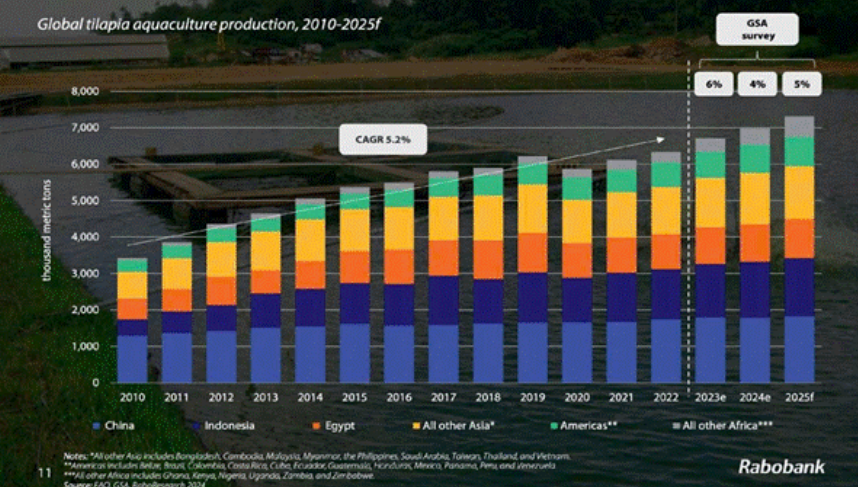

Global Growth Rate of the Tilapia Industry

Between 2010 and 2022, global tilapia production grew at a rate of over 5% annually. Forecasts for 2023–2025 estimate a growth rate of 4–6%. China continues to dominate as the global capital of tilapia farming. However, Indonesia is rapidly gaining momentum and is expected to become China's strongest competitor in the global tilapia market. Egypt follows, maintaining stable production levels in recent years and ranking among the top three tilapia-producing countries worldwide.

Currently, the United States is the largest consumer of tilapia globally. American consumers often prefer low-cost frozen tilapia fillets. China, Indonesia, and Brazil are the primary suppliers of tilapia to the U.S. market.

The European Union is the second-largest consumer bloc for tilapia. To export tilapia to the EU, suppliers must comply with strict certifications such as ASC and Global GAP. Indonesia and Vietnam are the two main suppliers of tilapia to the EU. These high product standards reflect the complexity of the EU market and indirectly indicate the high quality of products from its suppliers.

Additionally, the Middle East, South Korea, and Japan are important destinations for tilapia exports, offering a more diverse product range beyond just frozen fillets.

Source: vasep.com.vn

Aqua Mina's distributor in Japan: REX INDUSTRIES CO., LTD

- Address: 1-9-3 Hishiya-Higashi, Higashi-Osaka 578-0948 JAPAN

- Email: kimakubo@rexind.co.jp

- Phone: +81-(0)72-961-9893

- Website: http://www.rexind.co.jp/e/

WE WORK FOR YOUR SUCCESS!

Ngày đăng : 16/05/2025

2045 View

Other Articles

Indian shrimp pivot to the EU, increasing competitive pressure on Vietnam

Indoor shrimp farming in Europe: Investment challenges and the race to find a viable model

Shrimp production surged in the first month of the year, with exports benefiting from strong demand during the Lunar New Year holiday

Quang Ninh Accelerates Digital Transformation in Shrimp Farming, Rising to Lead Northern Vietnam

Lucky money is not just about cash — it’s Aqua Mina’s wish for a worry-free farming season for our valued customers

Việt Nam's top 10 seafood exporters command nearly one-fifth of industry revenue

Ca Mau Maintains Its Shrimp Brand in International Competition

VIETSHRIMP ASIA 2026 & AQUACULTURE VIETNAM 2026 – A TURNING POINT FOR THE MODERN SHRIMP FARMING INDUSTRY

Ecuador's shrimp industry educational program SustainED kicked off its 2026

An Giang will start raising brackish water shrimp as early as the beginning of 2026

Aqua Mina conducts the on-site installation of two aquaculture air blowers | Ceramic Ball Bearing – 15 kW – 25 kPa for a customer in Quang Ninh

Towards Building Brand Value for the Shrimp Industry

.jpg)